EDGE Bangladesh Mutual Fund

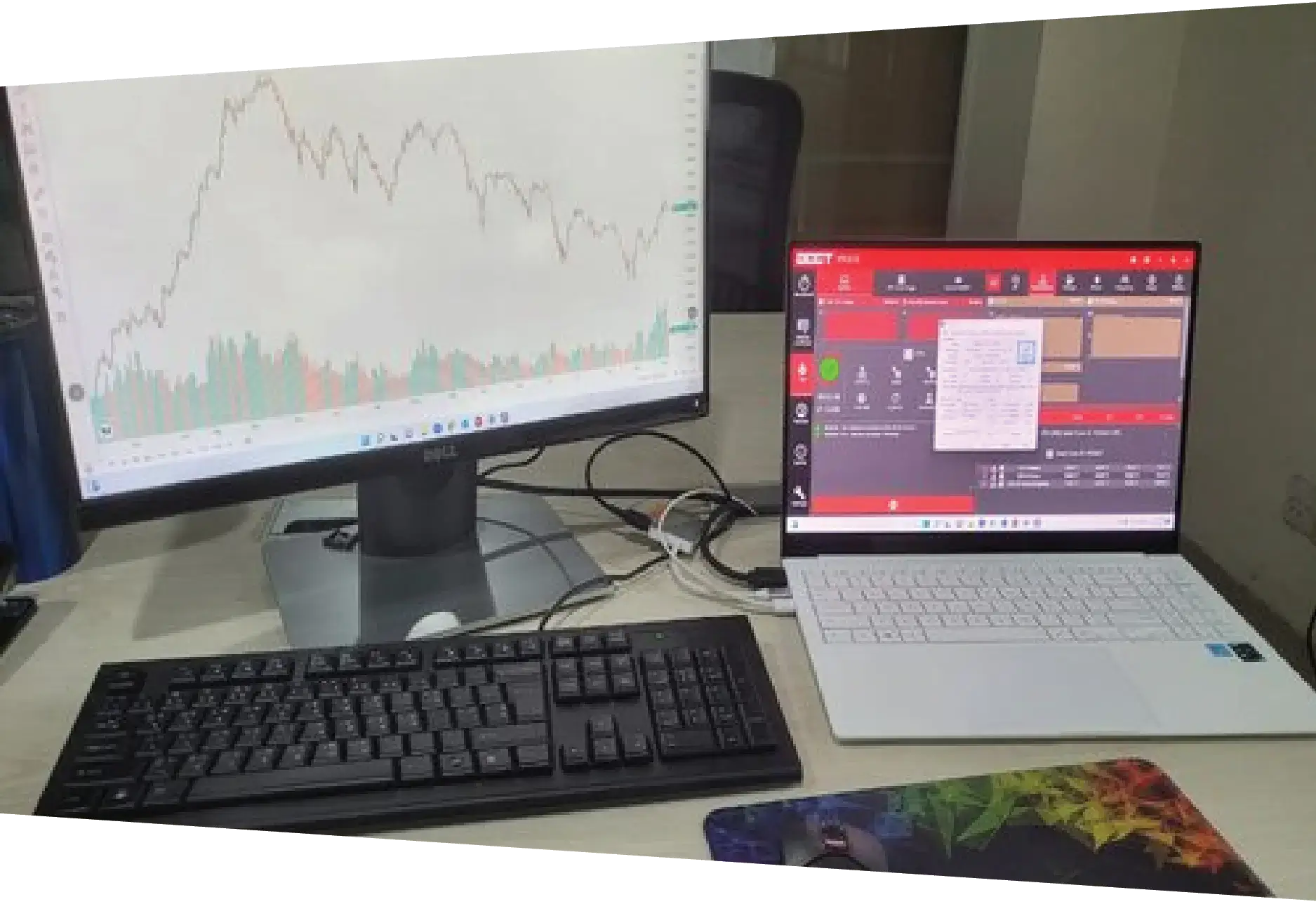

EDGE Bangladesh Mutual Fund (EDGEBDMF) provides a balanced allocation to both equity and debt securities where allocation is tilted based on relative attractiveness of the two asset classes. The presence of debt securities helps reduce volatility, downside risk and may also enhance return when equity market trends downwards.

EDGEBDMF has a moderate to low risk level. It is best suited for investors who do not want to manage their debt and equity allocations by themselves and who thus seek professional, dynamic fund management.

Invest Now Contact us