Reduce Your Income Tax Burden in Bangladesh by Investing in Eligible Securities

By Ashikur Rahman Tusar

Software Developer

EDGE AMC Limited

Posted on: 15 May, 2019

Don’t you feel great at the very sight of your paycheck at the end of a month of hard work? But that feeling soon subsides when we consider how much income taxes we have to pay on our salaries. Fortunately for us, there are a few investment vehicles that allow us to get rebates on our investments. By investing in these instruments, not only can we earn income, but we can also reduce our income tax burdens. In this post, we highlight three such investment options.

Direct stock investment: Direct investments in the stock market are eligible for investment rebates. This is a good option for people who have the knowledge and the time to make own stock picks. For retail investors, stock investments also have no capital gain tax which is a great additional incentive. Finally, there are no limits to how much a person can invest in the stock market.

Mutual Funds: However, not everyone has the knowledge and ability to invest directly by themselves. For investors who want to outsource this function, mutual funds are a great option. Mutual funds provide broad market exposure, without having to buy and sell individual stocks and bonds.

Like stocks, there is no limit to how much you can invest. Similarly, there is no capital gain tax for individuals. In addition, the dividends also benefit from special treatment as the first BDT 25,000 is exempt from taxes.

National Savings Certificate/ Sanchayapatra: A popular risk-free investment vehicle is the Sanchayapatra (also known as savings certificates; savings instruments). It gives a much higher return than other fixed income savings instruments because the interest is not market determined.

The maximum amount that an individual can invest and the associated rate of interest depends on the type of Sachayapatra they plan on buying. While investing, you must take into account that this investment is locked and cannot be withdrawn for a specified period of time.

Appendix – Rebate calculation

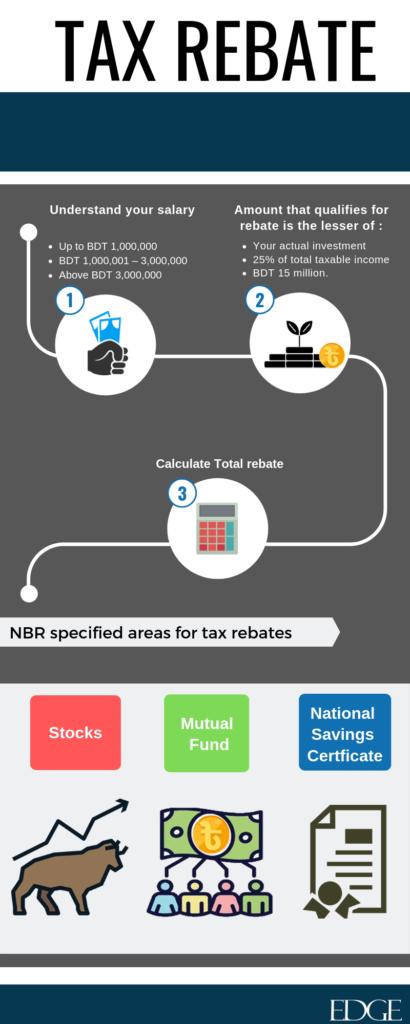

How much rebate can you expect from making these investments? We will address this question in this segment. We’ll first look into your amount of investment and how much qualifies for a tax rebate (check the excel file for calculation).

The amount of investment that qualifies for tax rebate is the lesser of:

Actual investment

25% of total taxable income

BDT 15 million

The tax rebate ranges from 10-15% of the allowable investment based on the income slab.

- Tags:

- Tax rebate, reduce income tax, tax burden, tax, eligible securities

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.