Reassessing Government Borrowing Strategies: The Case for Short-Term Treasury Securities

By Asif Khan, CFA

Chairman

EDGE AMC Limited

Posted on: 11 May, 2024

When borrowing rates are high its smarter to borrow less in longer durations and borrow more in shorter. That means the borrower is not locking up high rates for long term.

In the case of bank borrowing, sometimes there is scope to refinance at a lower interest rates once rates have fallen enough. However when the government is borrowing via treasury instruments the securities are not 'callable'. This implies that government cannot repay the debt ahead of schedule and refinance at lower costs. This makes debt management absolutely essential to ensure the tax payers don't have unnecessary burden.

In recent times yields on treasury securities have hit multi decade highs. The rates are also significantly higher than current inflation rates. This is the time short term borrowing should increase.

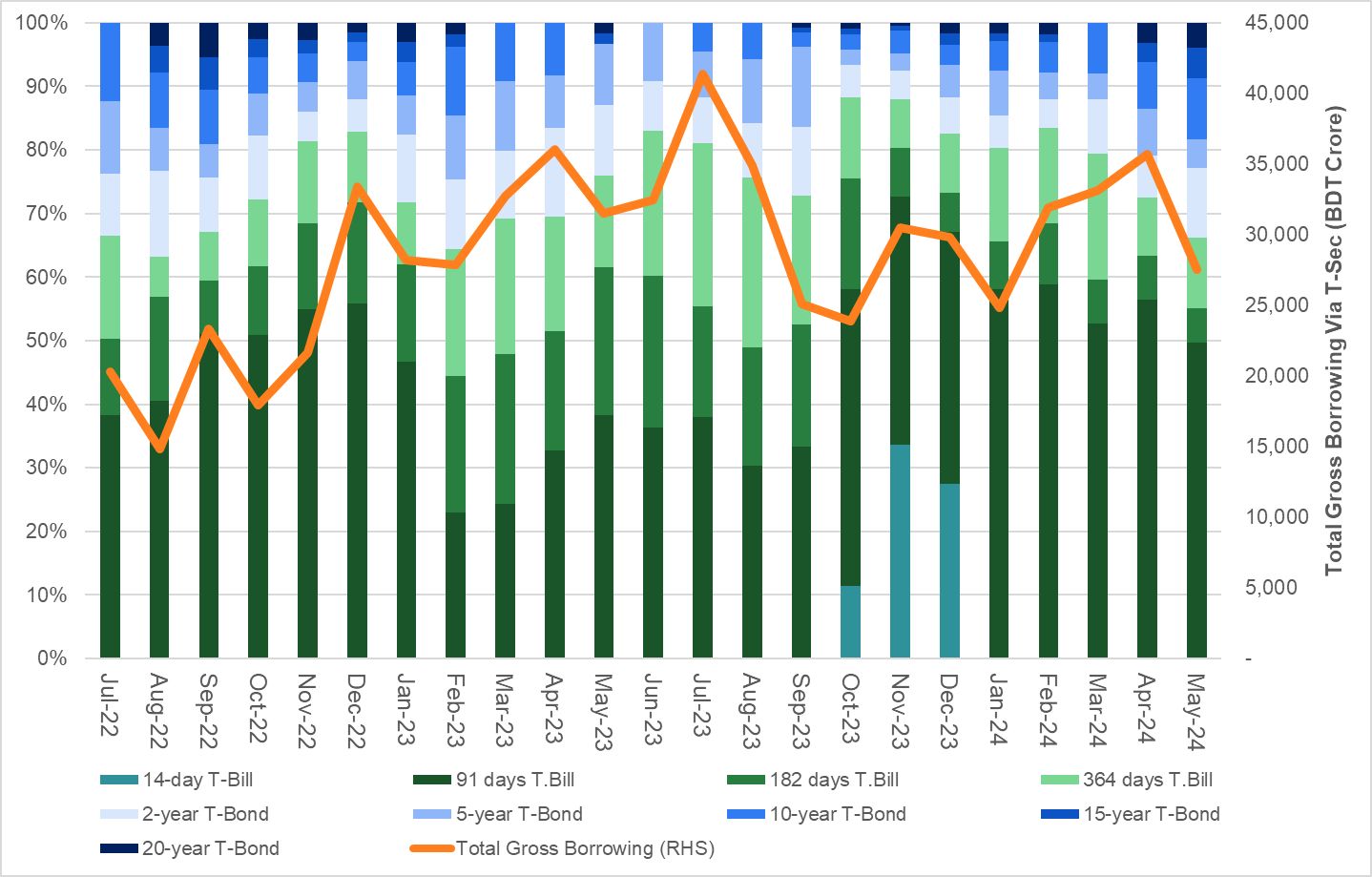

In reality we did the opposite. As per the chart below we have increased borrowing via treasury bonds and decreased via bills. As a result the yield curve went through a 'bear steepening' at the peak of the rate cycle!! In a bear steepening long term yields increase more than short term ones.

I am urging our policymakers to reconsider this strategy. When fiscal pressure is rising let us not burden our tax payers for long periods. Once yields drop we can move into longer tenor instruments.

Chart created by EDGE Research team.

- Tags:

- Government Borrowing, Treasury Securities, Debt Management, Fiscal Policy, Economic Strategy, Interest Rates, Yield Curve, Short-Term vs Long-Term Debt, Inflation Rates, Bear Steepening, Financial Management, Taxpayer Burden

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.