Navigating the Anomalies in Fixed Deposit and Treasury Yield Rates in Bangladesh

By Asif Khan, CFA

Chairman

EDGE AMC Limited

Posted on: 30 Jun, 2024

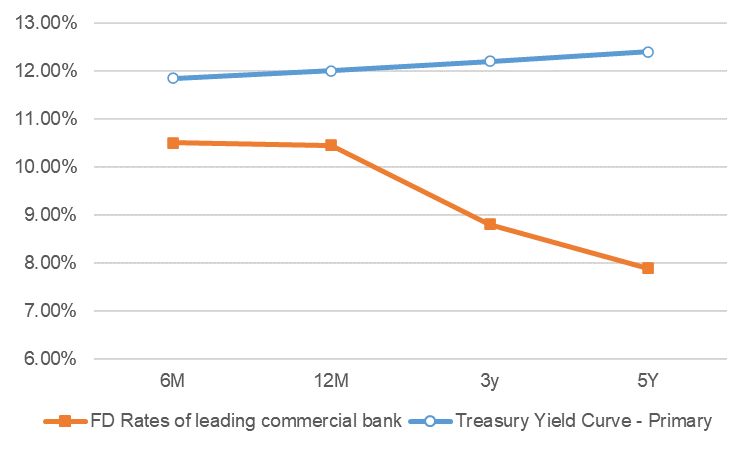

Today I went to a leading commercial bank and inquired about long-term Fixed Deposit rates. They offer up to 3 years in tenor but also mentioned that long-term rates are lower than short-term rates. They expect rates to decline in 6 months.

I then checked the long-term rates of another leading commercial bank and found a similar situation. The rates decline as time passes and this mainly reflects the expectation of bank treasury teams about future interest rates. Nobody wants to borrow long term when interest rates are high (as is the case now).

The anomaly however is in the yield curve shape for treasury securities. I had written about this issue in the past also. The treasury security market yields show an upward-sloping curve. The same commercial banks setting fixed deposit rates are the biggest players in the treasury market. And it is probably the same treasury teams deciding on both issues.

Yet the embedded expectations are the opposite. Both cannot be true at the same time. In my humble opinion, the treasury curve is incorrect as it embeds high inflation expectations despite short-term rates being at a multi-decade high.

The other strange issue is fixed deposit rates of top banks are lower than treasuries. From a risk and liquidity standpoint, the latter are safer and hence should have lower returns than fixed deposits. The explanation here is straightforward because it appears that the vast majority of retail depositors are unaware of treasury instruments as an investment vehicle and/or don't know how to get exposure.

p.s. The 3-year treasury yield was extrapolated using 12 months and 5 years. It's an oversimplification as the former is zero coupon and the latter is coupon bearing but for our purpose, this is reflective enough.

- Tags:

- Bangladesh Finance, Fixed Deposits, Treasury Securities, Interest Rates, Banking Sector, Economic Insights, Investment Strategies, Yield Curve, Inflation Expectations, Retail Depositors

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.