Banking Sector Consolidation in Bangladesh: Navigating Challenges and Future Prospects

By Asif Khan, CFA

Chairman

EDGE AMC Limited

Posted on: 03 Sep, 2024

Bangladesh has around 61 licensed commercial banks. That makes our banking sector one of the most fragmented in the world.

One key hypothesis we had at EDGE for some time is that the sector would consolidate. In phase one, the consolidation would be organic as flight to quality takes place. In phase two, we may see the regulator clamp down on banks that can't meet minimum capital standards.

Right now we are in phase one. Once oblivious depositors have started to face the reality that contrary to 'folklore' the idea of banks never failing is a myth.

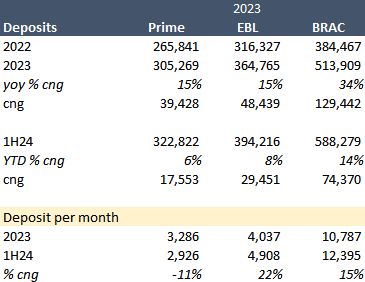

I recently looked at the deposit growth number of three top tier banks in Bangladesh (not an exhaustive list). All three are growing deposits faster than the sector. Prime at 1.5x, EBL at 2.0x and BRAC at a spectacular 4.0x sectoral growth (roughly).

I hold a somewhat unpopular opinion that depositors have to take some of the blame for what transpired in the banking sector. Placing deposits in the banks offerring highest interest rates and then demanding to be made full will only lead to moral hazard.

My guess is government has not decided exactly what the plan is. Step 1 is assessing the health of the banks. But very likely we may end up with a mix of some form of recapitalization and some haircuts for depositors.

I am pretty sure we will see the number of banks decline in Bangladesh in the next decade which means we are entering phase 2 of the consolidation soon.

p.s. Numbers are in BDTmn

- Tags:

- Bangladesh banking sector, bank consolidation, deposit growth, financial stability, regulatory changes, capital standards, moral hazard, banking challenges, EDGE insights, economic forecast

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.