Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

By Asif Khan, CFA

Chairman

EDGE AMC Limited

Posted on: 28 Sep, 2024

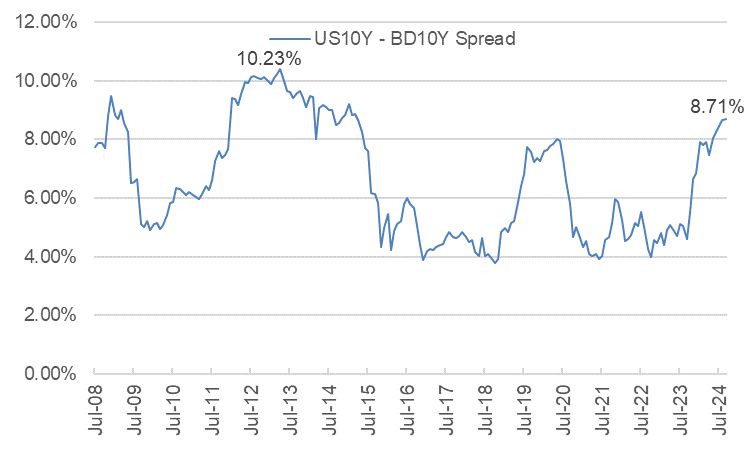

The yield spread between a US10Y bond and a Bangladeshi 10Y bond has reached 8.71%. This is the highest it has been since March 2015. I have data collected all the back till July 2008 and from that period till now the highest spread we had was 10.23%. We might get close to that number with global central banks including the Fed cutting rates.

Mathematically, for an investor who can invest in USD or BDT, it makes sense to invest in USD only if it appreciates by more than 8.71% per year against BDT for the next 10 years. What are the odds of that happening?

FX reserves have stabilized in Bangladesh as has the USD/BDT exchange rate. USD is likely to appreciate against BDT every year due to the inherent inflation differential between the two countries. But that is unlikely to be 8.71% per year.

If the spread goes back to the historical average we are looking at a drop of 213 bps for the 10-year Bangladesh Government Treasury Bond. Just for fun here is the pre-tax return for an investor who buys a 10Y bond at the last auction yield of 12.5% and sells after 1 year. Also, assume yield falls by 213bps in a year.

Total Return = Coupon + Capital Gain = Coupon + Mduration*2.13%

= 12.5% + 5.31*2.13% = 23.8%.

p.s. None of this is investment advice. There is always some risk involved in any trade. However, sometimes the risk-reward ratio is exceedingly good where the upside is far higher than the downside.

- Tags:

- Bangladesh 10Y bond, yield spread, US10Y bond, FX risk, USD/BDT exchange rate, inflation differential, bond investment, capital gains, bond yields, investment potential

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.