Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

By Asif Khan, CFA

Chairman

EDGE AMC Limited

Posted on: 29 Sep, 2024

Yesterday after my post on the spread between USD 10Y and Bangladeshi 10Y bond yields, some questions were raised about currency risks. Before delving further into the matter, let me reiterate my core argument. Market-implied depreciation per year for BDT is around 8.71%. In contrast, long-term average depreciation per year is between 3 and 4%, broadly consistent with inflation differentials. I am simply arguing that BDT depreciation is likely to be less than 8.71% per year.

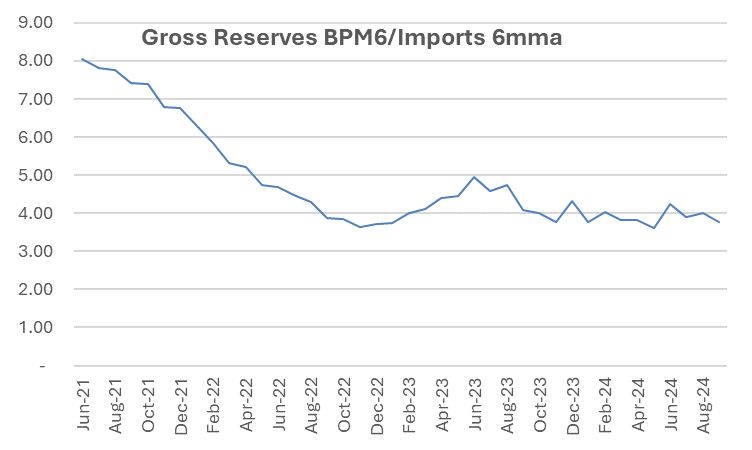

Now that we have cleared that up let's have a look at what the latest data is suggesting about currency risks. The chart below shows the import coverage using gross FX reserves and 6-month average imports. The data is very clear that we have been able to stem the decline of reserves. 4 months of import cover on gross reserves is nothing spectacular but it's not too shabby either.

What happened to the exchange rate in this period? I try to track kerb market rates or rates on remittances as they have proven to be a better indicator of fair market rates. Kerb rates peaked at 130 in late 2023. After that, it dropped back to 119-120 only to hit 125 twice. The first was when a crawling peg was introduced and second was right after the regime change. It has not been able to sustain at 125 and BDT has appreciated from those levels.

There are some other positives. Fed has started cutting rates which bodes well for our financial account. Oil prices remain weak helping a net commodity importer like Bangladesh. The current account in July was a slight deficit despite the lower-than-usual remittances (caused by the protests) and reserves have not dropped too sharply even though Bangladesh is clearing past overdue payments. Finally, Bangladesh has received significant commitments from multilateral agencies such as WB, ADB, IMF, etc.

I think the worst is over for the external sector. In fact once the $1.2bn backlog is cleared up we may start seeing some current account surpluses.

I would prefer to see us move out of the crawling peg and into a more market-driven rate regime. That will allow automatic adjustments of any pressure buildup.

- Tags:

- Bangladesh currency risks, BDT depreciation, exchange rate analysis, FX reserves, import coverage, kerb market rates, remittances, external sector, current account balance, market-driven exchange rate

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.