Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

By Asif Khan, CFA

Chairman

EDGE AMC Limited

Posted on: 03 Oct, 2024

BBS reported September 2024 inflation yesterday.

CPI: YoY +9.91%/MoM +0.98%

Food: YoY +10.40%/MoM +1.11%

Non-Food: YoY +9.49%/ MoM +0.87%

BBS data suggests that inflation has declined YoY compared to August (+10.49%). However, this is due to base effects as we see MoM increase is still high at +0.98% (which annualized is over 12%).

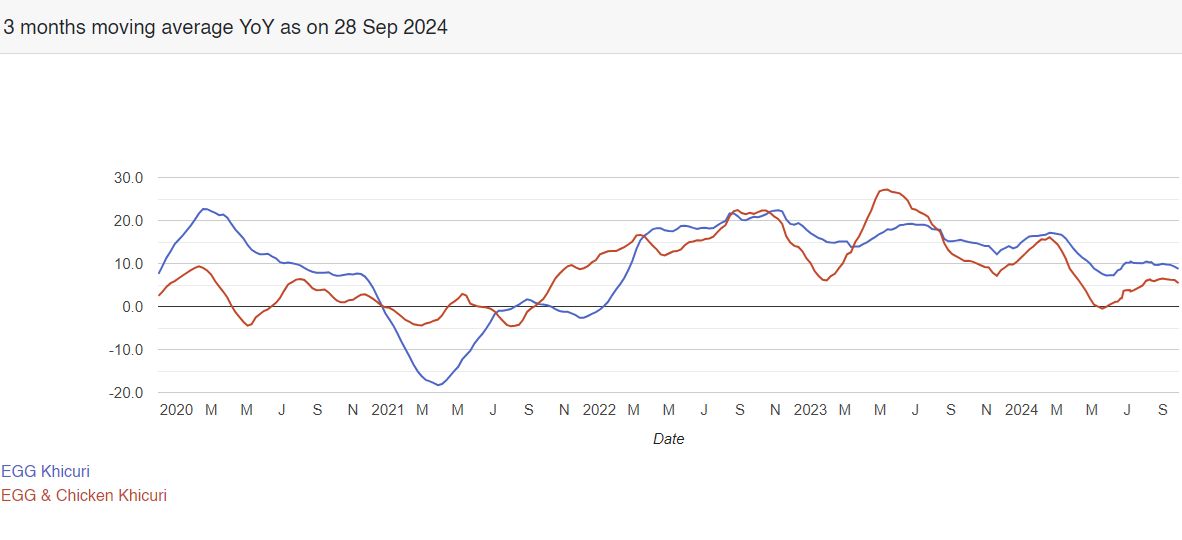

We can match this number with our estimate of food inflation. Our Egg Khichuri index also printed exactly 10.4% YoY (a coincidence as the baskets differ). However, if we include Chicken which is a high-value item our index falls significantly (Chicken Khichuri Index at +4.5% YoY).

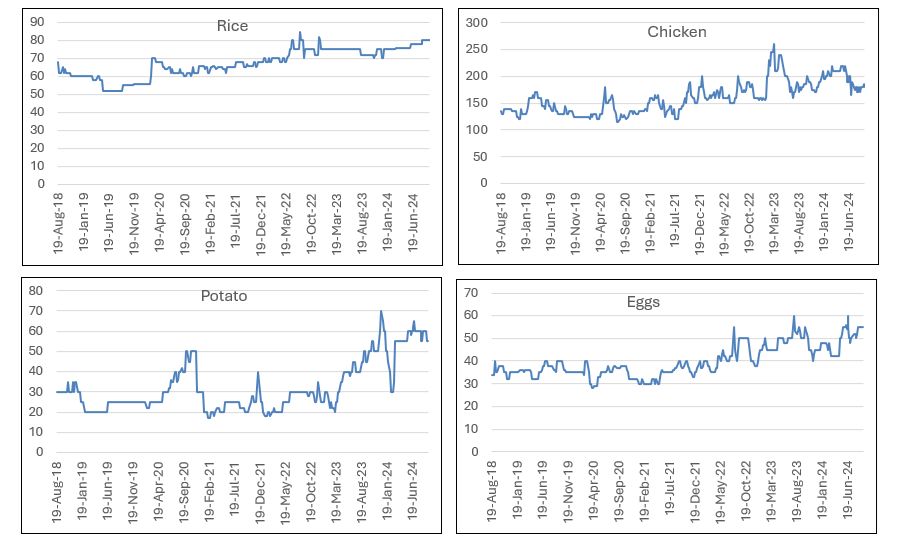

What is more important is that inflationary pressures appear to be coming down. This can be confirmed in two ways. Firstly, the chart showing 3mma yoy % change in khichuri price is trending downwards. Secondly, we can look at selected commodity prices and check their trend also.

Remember, inflation is a % increase in price. If prices went up a lot and remained unchanged that means inflation has declined substantially. Prices falling is deflation.

- Tags:

- Inflation, Price, Food Inflation, Egg Khichuri Index, Chicken Khichuri Index

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.