Analyzing Food Inflation Trends in Bangladesh: Stabilization and Future Projections

By Asif Khan, CFA

Chairman

EDGE AMC Limited

Posted on: 30 Apr, 2024

Quick update on the food inflation situation in Bangladesh. Food makes up a big % of the inflation basket in terms of weight. It's also easy to track the food price inflation and compare it with the BBS-reported version.

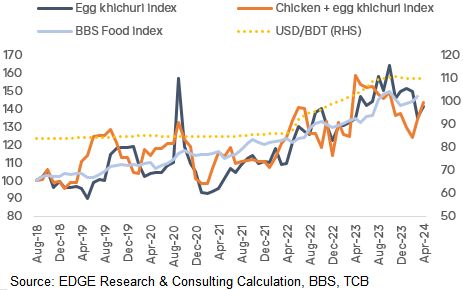

Broadly the rapid uptrend in food prices seems to have stopped. Index values peaked in Mid 2023. After some decline, we saw an uptick during Ramadan. We are still waiting for April 2024 BBS data to compare with our version of food inflation.

I have written in the past also that the inflation we experienced in the last 2 years was supply side. Bangladesh did not have significant monetary base growth and neither did we have a huge fiscal deficit, unlike our Western counterparts. Right now Narrow Money growth is below 1% and the government has been forced to reign back on fiscal expenditure.

IMF also estimated that in 2023, 5% out of 10% of inflation (50% of the total hike in prices) was driven by currency depreciation. The rest can be attributed to inventory shortages and monetary base growth.

Right now, the exchange rate seems to have stabilized to an extent. Hence the incremental price growth due to depreciation looks unlikely (unless we get other shocks like oil price hikes). The USD liquidity situation has not normalized fully so commodity inventories are probably still fairly low. The only logical reason for inflation to remain sticky is the inventory situation and possible cartelization.

Yet, it's hard to forecast prices increasing further in an economy experiencing slowing growth and high real interest rates (bill yields are around 150bps higher than reported inflation). Remember inflation is a % increase in prices. My base case assumption is inflation coming down slowly towards the end of the year.

p.s. Look at the correlation between exchange rate and food price index.

- Tags:

- Food inflation, Bangladesh economy, currency depreciation, inflation basket, supply-side inflation, monetary policy, fiscal policy, exchange rate stability, inventory shortages, IMF estimates, commodity prices, cartelization, real interest rates, economic growth, price index correlation

Search

Categories

Recent Post

-

EDGE Government Security Index (EDGEGSI) Starts 2025 with Strongest January Gain Since 2010

18 Feb, 2025 -

Analyzing September 2024 Inflation: Signs of Easing Price Pressures Amid Base Effects

03 Oct, 2024 -

Bangladesh Equity Market Outlook: Low Valuations and Future Growth Potential Amid Political and Economic Uncertainty

02 Oct, 2024 -

Assessing Currency Risks for Bangladesh: Why the Worst May Be Over for the BDT

29 Sep, 2024 -

Bangladesh 10Y Bond Yield Spread Hits 8.71%: Exploring the Investment Potential and FX Risk

28 Sep, 2024

Have Any Question?

If you have any questions feel free to reach out to us via phone or email.